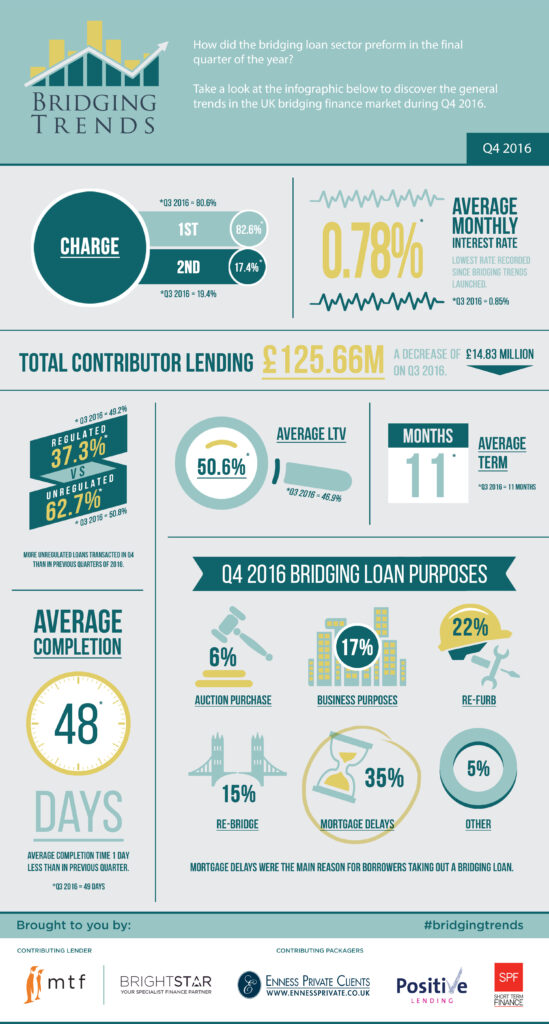

Take a look at the infographic below to see the trends that shaped the bridging finance market in Q4 2016.

Key Points:

£50.1m more business transacted by contributors

Average interest rates fell to a low of 0.78% in Q4

Mortgage delays most popular use for bridging loans

Lending peaked during Q3 at £140.49m

Director’s comments

Joshua Elash, director of bridging finance lender, MTF:

“The final figures for 2016 show strong demand for bridging loans. Interest rates were again under consistent downward pressure throughout the year, as the bridging sector continued to be highly competitive.

““The recent data is interesting as we are certainly witnessing consistency in the key market parameters we are seeking to benchmark.”

Chris Whitney, Head of Specialist Lending at Enness Private Clients:

“The bridging finance market has been shrouded in uncertainty throughout 2016. Political issues both in the UK and overseas – including Brexit, the US election and the far right gathering ground in Europe – have led to an increase in activity volumes for specialist lenders in our opinion, as lenders outside this space took their time to evaluate the potential impacts, holding back from lending.

““The fall in average monthly interest rates is a reflection of continued increased competition within the industry – however, it would be more beneficial to see greater innovation within the specialist lending sphere, rather than simply keener pricing.

“The fall in average monthly interest rates is a reflection of continued increased competition within the industry – however, it would be more beneficial to see greater innovation within the specialist lending sphere, rather than simply keener pricing.

“It is slightly surprising to see the number of regulated loans among specialist lenders decreasing in Q4, as we are still finding that high street lenders are struggling to come to terms with regulations, suggesting that specialist lenders may pick up these cases. This year, the percentage of regulated business may increase as we are aware of several non-regulated lenders looking to become regulated in 2017, resulting in a potential increase in regulated activity. Average loan to value remains at modest levels, indicating that the industry is continuing its responsible lending policies. Furthermore, with the cost of borrowing from the high street at an all-time low, we may see an increase in the number of second charge loans throughout 2017 with borrowers taking whatever they can at very low rates and ‘toping up’ from the specialist lending arena.”

Kit Thompson, Director of Bridging & Development at Brightstar Financial:

“The bridging Trends data for Q4 and across the whole of 2016 shows that the sector remains strong and is still growing, although growth in 2016 slowed when compared to the previous year’s growth. Against a backdrop of political and economic surprises with Brexit, Trump, Stamp Duty and Tax relief changes, this is encouraging. No surprise that average rates have reduced, with increased competition in the sector, lenders have had to drop pricing to remain competitive and keep market share.

“New entrants continue to join the sector and lenders are awash with cash to lend. Non-regulated bridging transactions will always outstrip regulated and LTVs remained reassuringly comfortable for lenders, promoting sensible lending practise throughout our industry. January has started very strong and we expect another strong growth year for bridging.”

Chris Borwick, Director of SPF Short Term Finance said:

“SPF Short Term Finance saw an increase of 1st charge regulated bridging transactions completing in Q4, the majority of these being taken out to save an ongoing purchase of a new main residence. Q4 also saw the beginnings of a mini rate war with low loan to value residential bridging rates being cut to new lows: this has continued into Q1 of 2017.

“Although there are the obvious external factors that may have a bearing on how 2017 unfolds the market remains resilient and we are confident of a good year ahead.”