Key Points:

Director’s comments

Chris Whitney, Head of Specialist Lending at Enness Global comments:

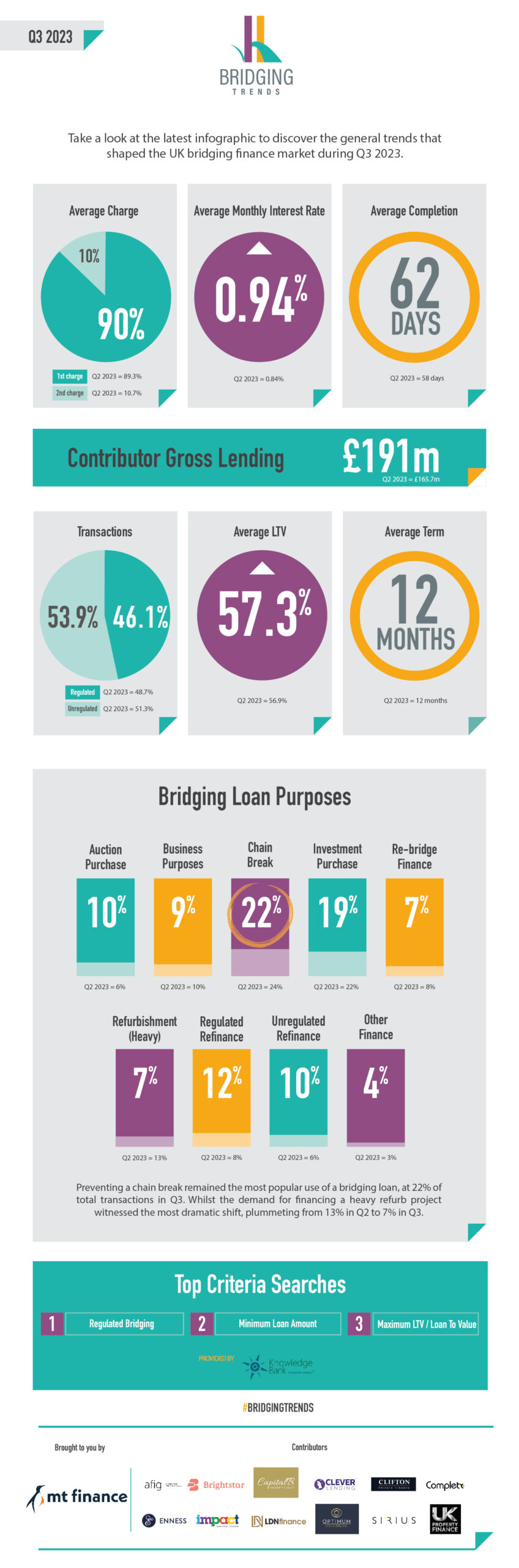

“Increased completion times have been a topic of hot conversation in the industry for some time now and reflected, frustratingly in the data here. I appreciate we had the summer period but still think this is heading in the wrong direction. We will see next quarter how that looks with interest.

“This time around we see the average interest rate on par with 2015 levels. Bank of England’s base rate was 0.5% back then compared to our 5.25% currently. Therefore, the true cost of borrowing hasn’t gone up proportionately with the base rate increases within the bridging loans sector, possibly kept low by good levels of liquidity within the UK market and increased competition.

“Nice to see the lending figure rise by 15%. I think the market has made the flexibility and nimbleness of a bridge loan a very useful tool for many more borrowers. I also think we have seen the HNW & UHNW community starting to use bridge loans more and there have been greater volumes of bigger ticket transactions taking place, some lenders even setting their stall out to cater for this sector of the market.”

William Lloyd-Hayward, Group Chief Operating Officer at Brightstar Group comments:

“The latest Bridging Trends continues to demonstrate the ongoing resilience and versatility of the bridging market. Interest rates have increased, just as they have in the mainstream market.

“However, unlike the term mortgage market, lending continues to climb. One area to note is that completion times are also increasing. This is likely to be partly down to the sluggish property market, but it does put more emphasis on brokers partnering with an expert in the sector to ensure they are choosing the best bridging lender to meet the demands of their clients and securing the best client outcomes”.

Chris Borwick, Director of Capital B Property Finance comments:

“Against a backdrop of mortgage approvals falling to their lowest level since January, it is heartening for those operating in the specialist sector to see some good news in the form of bridging lending volumes jumping by 15.3% in Q3. Yes, rates are up, as they are across the whole lending market due to the run of 14 months of base rate rises, but lenders have found a way to keep pricing competitive and mitigate the impact.

“Despite these positives, I’m sure all brokers will agree that the market remains challenging, and this is reflected in the increased completion times. Expertise and market knowledge has never been more crucial.”

Matthew Dilks, Bridging & Commercial Specialist at Clever Lending comments:

“As shown in these latest figures, the demand for regulated bridging remains high as we continue to see high demand due to broken chains, plus also people wishing to downsize. An increasing number of brokers who have not previously explored bridging finance are turning to us for support, including guidance and advice, thus facilitating a noticeable uptick in broker engagement with bridging services.”