Key Points:

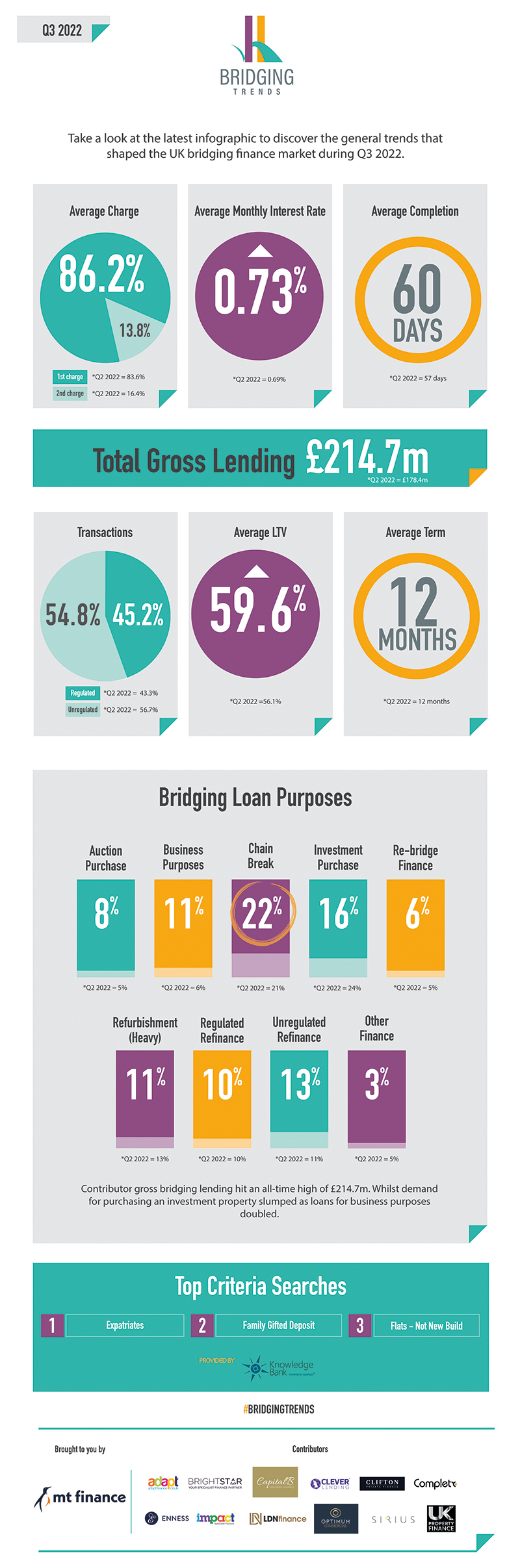

20% rise in bridging activity

Investment property purchase demand slumps

Director’s comments

Sam O’Neill, Head of Bridging, Clifton Private Finance comments:

“The total gross lending will be an interesting benchmark for the next quarter given the current uncertainty of the market. With uncertainty comes opportunity, and we are already seeing investors looking to capitalise on under market value transactions caused by panic selling vendors.

“I anticipate investment purchases to increase in the next few months. I would be interested to see the re-bridging figure in the next quarters statistics. Current bridging loans nearing their term’s end are subject to more stringent criteria on mortgages and an uncertain buying/selling market. Will more lenders who don’t currently consider re-bridging see this as an opportunity? Or a necessity to keep pace with other lenders and the demands of the market?”

Stephen Watts, Bridging & Development Finance Specialist, Brightstar comments:

“Following the base rate rises we’ve seen throughout this year and mortgage interest rates increasing across the industry, it’s no surprise that chain break bridging is the biggest use of funds for the quarter.

“Borrowers that have had mortgage products withdrawn on them with little or no notice or have lost their sale due to their buyers no longer fitting mortgage affordability criteria, would then turn to short-term funding solutions to ensure their purchase can still go through as planned. It will be interesting to see how this impacts on next quarter’s data.”

“Gareth Lewis, Commercial Director, MT Finance comments:

“Considering the volumes we have seen in Q3, bridging finance clearly continues to be a useful tool for homeowners and investors alike. What has been interesting is the drop-off in bridging being utilised for investment purchases, which is likely due to buyers taking stock of the current market. While it’s too early for us to really feel the impact of September’s mini-budget, I expect this will be more visible in Q4.

“As predicted in Q2, interest rates have started to slowly rise to 0.73% but it is worth noting they are virtually on par with Q3 in 2021 (0.72%). What comes next remains to be seen.”