How did the bridging loan sector perform in the third quarter of 2021?

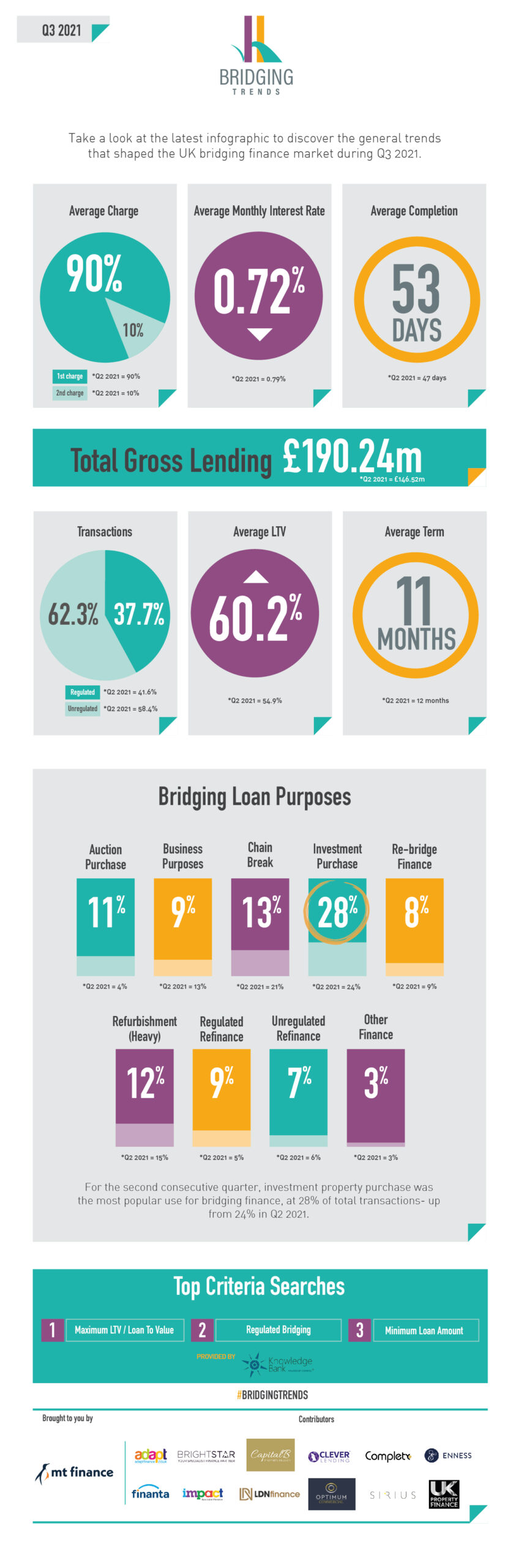

Take a look at the latest infographic to discover the general trends that shaped the UK bridging finance market during Q3 2021.

Key Points:

65% annual increase in gross lending

Average LTV jumps to highest level recorded

Funding an investment purchase most popular use

Director’s comments

Stephen Burns, co-founder of Adapt Finance comments:

“The most exciting part to read is “returns to” when referring to activity levels. It shows the industry was affected by the disruption the Coronavirus pandemic put the country through, but more so, how it has pulled back quickly, and we are now firing on all cylinders!”

Dale Jannels, MD of impact Specialist Finance comments:

“These figures show that bridging finance is now a better understood product for many brokers and they have much more confidence in recommending this solution to their customers.

“The Stamp Duty holiday has helped bridging finance to be more widely accepted by the mainstream industry as a need to meet speed demands, but investors with the intention to renovate have also been at the forefront of recent requests.”

Chris Whitney, Head of Specialist Lending at Enness Global comments:

“Bridging Trends is a great concept and is fantastic at letting the industry know where the key indicators are heading and over the years, we have seen how micro and macro factors (i.e., Brexit etc) have impacted upon us. However, with the news that contributor gross bridging loans are over £190m it makes me wonder how big this market really is in its entirety.

“LTVs are up with borrowers possibly taking advantage of increasingly cheaper money in the light of reports that mortgage rates in general are heading upwards imminently. However, with continuing competition and even more new entrants in the short-term lending space, it will be interesting to see how that pans out with so many lenders looking to increase market share in a seemingly very liquid environment. However, at 60% LTV I think we are still seeing prudent levels of borrowing by people and responsible lending from the funders.

“I was not surprised to see processing times up. With increased volumes I think we have seen things take longer, with many lenders struggling to recruit good underwriters and valuers stretched to the limit. With the highest use of funds being for investment purchase I think it really shows how much confidence people have in UK real estate.”

Chris Oatway, director of LDNfinance comments:

“It surprises me that the average LTV is at record high levels at just 60%. In general, we have seen considerable demand for higher leverage deals at 70% to 75% LTV, where clients keep as much equity in their back pockets for future investments.

“Regulated transactions accounting for over a third of the market stands out when you consider the limited number of bridging lenders who are able to transact regulated business and shows there’s opportunity there for more lenders to enter this market.”