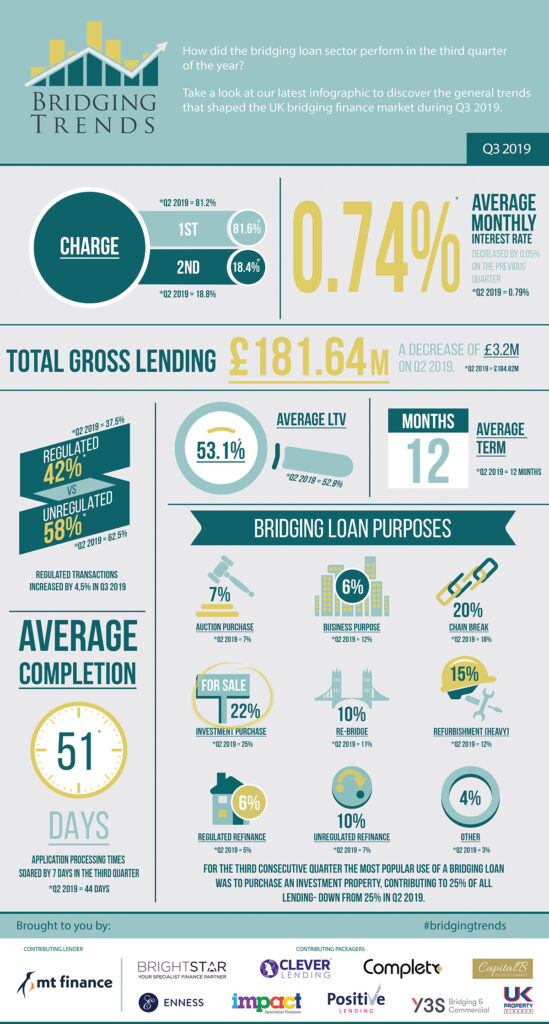

Take a look at the infographic below to see the trends that shaped the bridging finance market in the third quarter of 2019.

Key Points:

Property investment purchase most popular reason for bridging finance

Average monthly interest rate falls to 0.74%

42% of total loans transacted were regulated

Gross contributor lending falls by £3.2m

Director’s comments

Gareth Lewis, Commercial Director at MT Finance, comments:

“Bridging loan activity for the third quarter remained stable, coupled with the most popular uses, is a good indication of strong demand from borrowers seeking to purchase property fast while prices are low, ahead of Brexit’s conclusion.

“It’s quite clear that the uncertainty of Brexit has had its effect on the London property market, with prices dropping significantly in many boroughs. This has prompted many property investors to utilise the speed of bridging loans to act quickly on opportunities. With the EU deadline now extended, it would be reasonable that we’ll see the same trends continue throughout the rest of the year.”

Andre Bartlett, Director of Capital B Property Finance, comments:

“Capital B is delighted to be included in the latest Bridging Trends figures. Our success over the last 18 months has meant we are now recording enough data for our figures to play an important part of this invaluable measure of our market.

“We are still seeing strong demand for regulated loans for chain breaking etc for good clients, at low LTV’s. The appetite for lenders for these types of deals remains healthy and rates continue to be consistently low and the competition is still fierce.

“The downside is average completion times for loans is heading in the wrong direction, but that may be due to matters outside of lenders’ hands. I would love to see the average completion time get down to below 40 days.”

Chris Whitney, Head of Specialist Lending at Enness, comments:

“I think these are strong and encouraging results. Whilst loan quanta were down on the previous quarter, it was less than 2% and during the summer holiday period as well.

“It is a buyers’ market right now, especially for international buyers who are also taking advantage of the weak pound. This, and suppressed prices due to the political uncertainty, means that many international buyers are picking up assets at over 20% lower than they might have been 3 years ago. Finance for international investors is widely available but the better loans tend to be with lenders who aren’t particularly quick. Some first-time overseas buyers also take a while to be educated in how the UK purchase and finance system works.

“As it is a buyers’ market many get good purchase prices agreed on the basis they can complete within a relatively short space of time. This means that the demand for the quick and straightforward short-term loans is very strong, so I am not surprised that ‘Purchasing Investment Property’ is the most popular reason in the index. Domestic investors need to use these products for similar reasons, quite often to also undertake improvements to the properties and getting them let before moving them on the longer-term investment loans.

“With average rates now just over 8.8% p.a. cost of funds is no longer a barrier to using a bridging loan in many situations that dictate that need. It’s actually knocking on the doors of some of the more expensive lenders commercial term loan pricing.

“A slightly puzzling element in the data is the (yet another) increase in completion times. 50 days in my view isn’t a ‘typical’ term we see. Although, I think most of us have those deals that do hang around forever which is quite possibly distorting the headline figures. An area to keep a close eye on, I think.

All in all, the bridging loan market continues to be strong and supporting the UK economy in many ways during difficult times. And we aren’t out of the woods yet…”