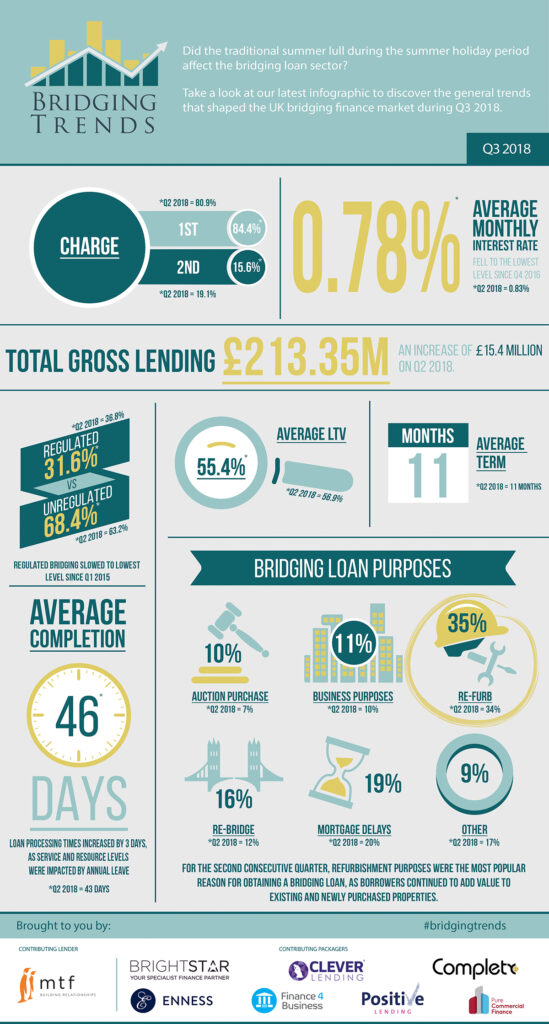

Take a look at the infographic below to see the trends that shaped the bridging finance market in the third quarter of 2018.

Key Points:

Regulated lending slows to lowest level since 2015

Average monthly interest rate lowest recorded since Q4 2016

Refurbishment most popular use for bridging finance for 2ndconsecutive quarter

Director’s comments

Gareth Lewis, Commercial Director at mtf comments:

“The data continues to show that property investors are seeking attractive opportunities to acquire properties where they can add value, a trend that shows no sign of slowing down.

“Conversely the transaction flow in the regulated space has continued to show signs of slowing down. Is this a direct response to the everyday purchaser taking stock of Brexit and holding fire before looking to commit to the purchase of a new residence?”

Sonny Gosai, Head of Specialist Lending at Clever Lending comments:

“Clever Lending is privileged to be on board with Bridging Trends, which provides much needed analysis of the market. The bridging industry is booming at present and forms a large part of our key distribution and remains one of our main focuses.

“Whilst the data suggests that there has been a drop in regulated bridging activity, we have recently set up a team solely to provide regulated bridging advice as we have seen a growth in this area particularly for enquiries. It will certainly be interesting to see what the next quarter’s Bridging Trends results will be.”

Luke Egan, Head of Specialist Property Finance at Pure Commercial Finance comments:

“Regarding the drop in regulated bridging transactions, we operate slightly different to a lot of specialist brokers as we take a large amount of direct business, so we have more regulated bridge enquiries as a lot of clients are home movers. However, the market is becoming more competitive which would explain the decline to an extent as there is a finite amount of business being passed around a larger number of people.

“Interest rates seem to be only going one way. Therefore, I believe one of the main regulated bridging lenders will drop their rates again soon in order to stand out in a crowded marketplace.

“Completion times increasing again is a worry, speed seems to a forgotten pre-requisite of bridging and more of a USP these days.”