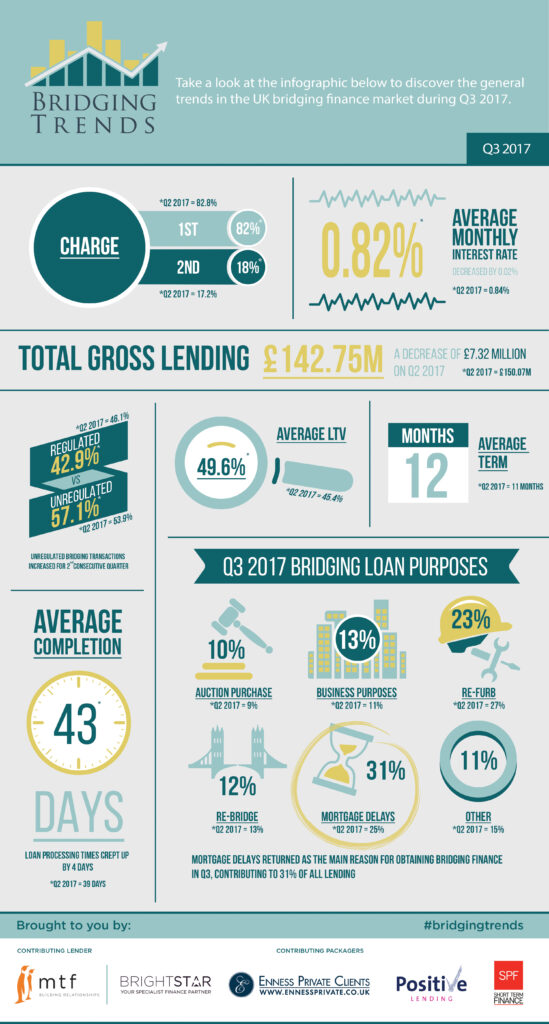

Take a look at the infographic below to see the trends that shaped the bridging finance market in the third quarter of 2017.

Key Points:

Contributor lending dips 4.9%

Average monthly interest rate drops 0.02%

Second charge lending rises for 2nd quarter

Mortgage delays return to most popular purpose

Director’s comments

Joshua Elash, director of bridging finance lender mtf, comments:

“Unregulated bridging loans continued to outperform regulated bridging loans- with the implementation of the Prudential Regulatory Authority’s rules relating to the treatment of portfolio landlords, this upward trend is likely to continue for the foreseeable future as an increasingly larger number of professional property investors will consider bridging finance when purchasing a new property which they otherwise intend to refurbish and sell.”

Chris Whitney Head of Specialist Lending, Enness Private Clients, comments:

“I think when you keep in mind the fact that this was over the summer holiday, a drop of only about 5% in lending volumes compared to the last quarter is actually quite impressive.

“I was surprised the average interest rate hadn’t fallen further than it has. We have seen pricing under quite a bit of downward pressure as certain lenders fight to increase market share and protect what they already have from new entrants.

“I think some lenders in the sector need to start thinking about streamlining completion processes. If a sizeable part of the market is bridging the gap between desired acquisition time and a standard term mortgage being put in place, if that bridge is taking longer to get the benefits of having it will diminish until it gets to the point where it isn’t worthwhile.”

Paul McGonigle, Chief Executive, Positive Lending, comments:

“I noticed an increase in transactional activity at Positive Lending in this quarter – quite significantly so. What was evident, and this report suggests the same, is that the larger loan transactions have reduced during the period.

“We have also seen a spike in unregulated activity, where investors are purchasing to refurb and sell and this trend will continue. As we approach the busiest quarter of the year it will be interesting to see how the new PRA changes impact the ability to obtain single unit investment properties in the more affluent areas, or if the investor looks toward more multi-unit properties for higher yields and a better opportunity to meet the lenders new income rules for professional landlords. Bridging lending I am sure will be in rude health in Q4 despite these new rules.”