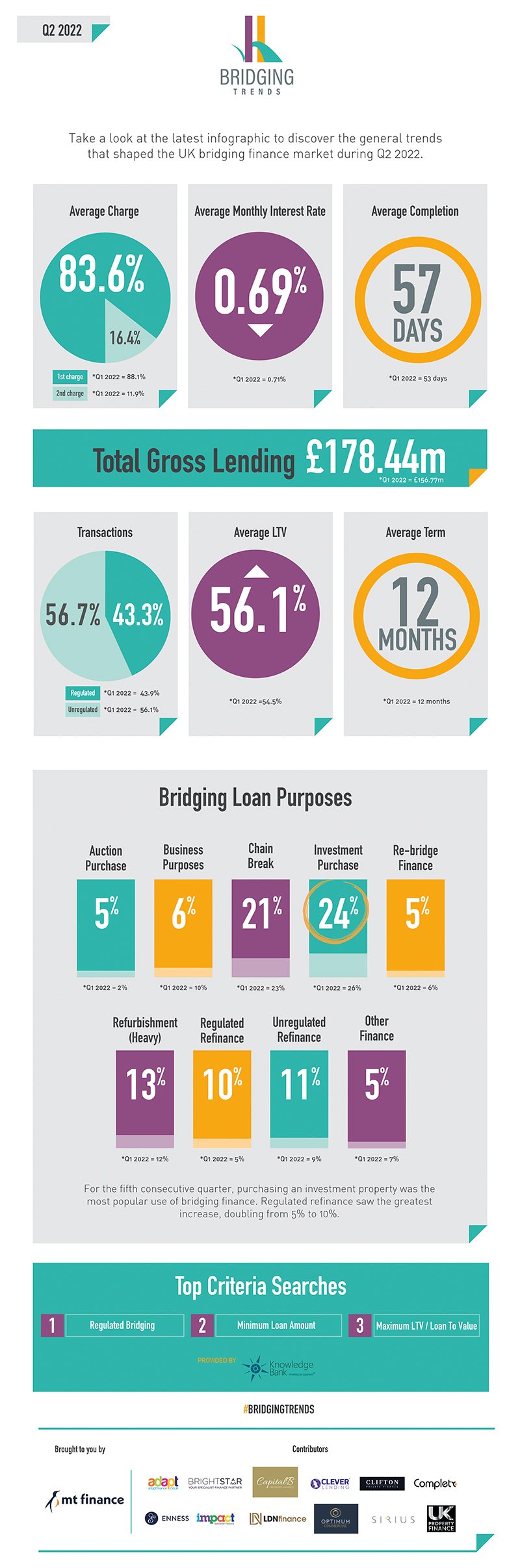

Take a look at the latest figures to discover the Bridging Trends that shaped the UK bridging finance market during Q2 2022.

Key Points:

14% increase in bridging loan activity

Competition driving bridging rates to lowest recorded

Regulated refinance shows greatest shift in demand

Completion times climb as industry feels pressure

Director’s comments

Stephen Watts, Bridging & Development Finance Specialist at Brightstar comments:

“It’s no surprise to see 83% of Q2’s bridging loans being on a first charge basis as the lending options for stand-alone second charges are fewer than they once were.

“It is also not surprising to see a 14% rise in bridging finance activity. The demand for property currently outweighs the number of suitable properties for sale to home buyers and investors, therefore, bridging finance is being increasingly sought to enable buyers to put themselves ahead of their competition. With recent statistics confirming on average, there are up to 29 potential buyers for each property on the market for sale, it’s not a shock to see such an increase in requirement for fast, short-term bridging finance.”

Andre Bartlett, Director of Capital B Property Finance comments:

“As always, the Bridging Trends data shows exactly what is happening in the industry. It is no surprise to see that volume has increased by 14% and in particular regulated refinancing showing the greatest uplift. There may now be some pressure on lenders to increase pricing, but we must remember they are at their lowest and bridging still represents excellent value for the right client.

“Lenders seem busier than ever, and completion timescales are slipping, and I feel this is a combination of staff shortages and the uplift in business. The industry is still well placed to provide much-needed assistance to clients over, what could be, some interesting times ahead.”

Gareth Lewis, commercial director of MT Finance comments:

“The bridging market has been fiercely competitive in recent times which has led to rate reductions, and bespoke pricing being offered. This trend has enabled lenders to create a competitive edge to try and gain market share. However, will we continue to see this in the coming months? I doubt it.