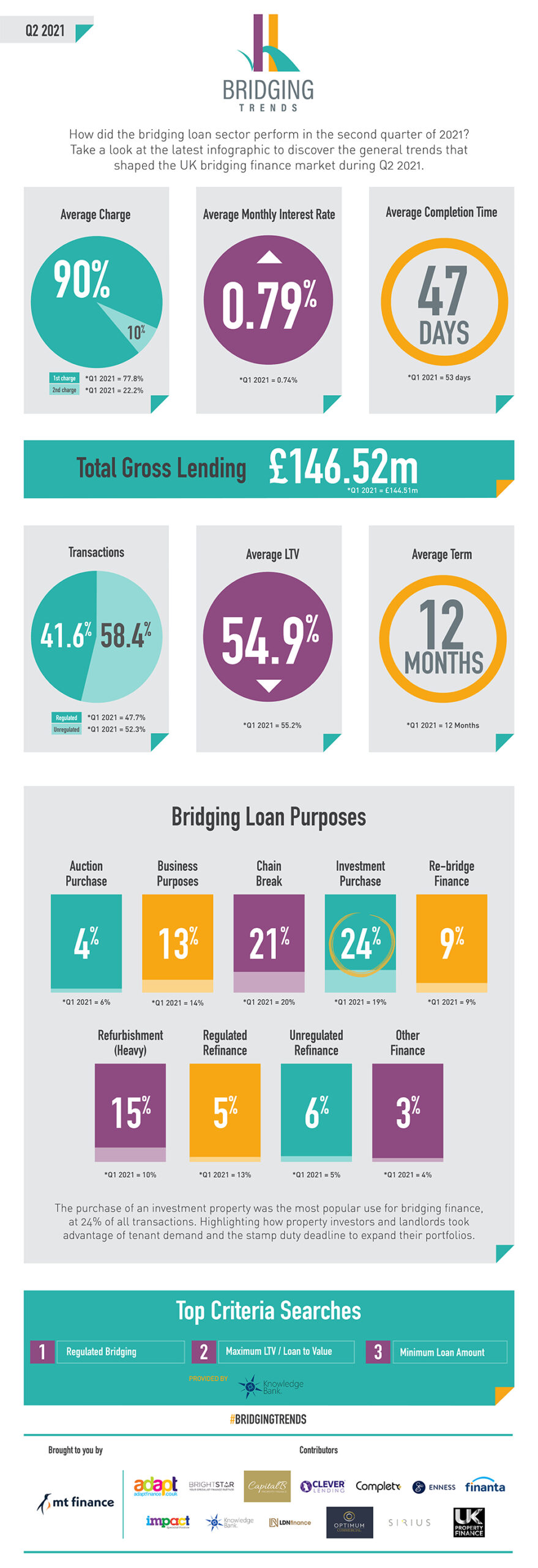

How did the bridging loan sector perform in the second quarter of 2021?

Take a look at the latest infographic to discover the general trends that shaped the UK bridging finance market during Q2 2021.

Key Points:

Annual contributor gross lending up 38% in 2021

Annual average LTV hits record high at 57%

Annual demand for 2nd charge loans falls to record low

Director’s comments

Joshua Elash, founding director of MT Finance comments:

“Whilst the year end data for 2021 shows a positive and steady recovery in the demand for specialist lending following a challenging 2020, gross lending figures for the year remained significantly down on pre-pandemic 2019. As we move forward into 2022, we expect gross lending figures to fully recover and surpass the 2019 gross figures as more and more investors return to the market with a view to taking early advantage of the anticipated impact inflationary pressures will have on asset prices. Indeed, we note that “investment purchase” is again the single largest demand driver for bridging finance.

“The industry is otherwise in excellent health and although “maximum LTV” is reported as being the top-rated criteria search by Knowledge Bank, it is noted that the average reported LTV of loans in the year sits comfortably below the 60% mark.”