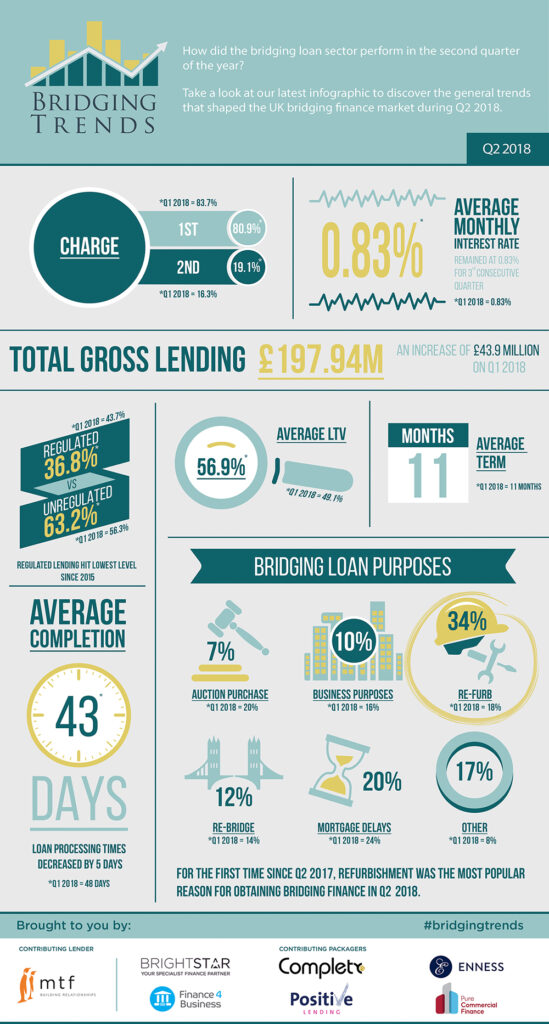

Take a look at the infographic below to see the trends that shaped the bridging finance market in the second quarter of 2018.

Key Points:

3 new contributors join Bridging Trends

Refurbishment most popular use for bridging finance

Regulated lending hits lowest level since 2015

Average monthly interest rate stays at 0.83% for 3rd consecutive quarter

Director’s comments

Gareth Lewis, Commercial Director at mtf comments:

“The new additions to Bridging Trends has given us a better spread of data reflecting a truer market commentary, this has been seen with the decrease in regulated figure.

“Unsurprising to see that refurbishment is the most popular purpose, especially given more property investors are looking to add value to property to help improve yield and capital value.”

Chris Whitney Head of Specialist Lending, Enness, comments:

“I don’t think many people will be surprised to see refurbishment loans taking centre stage this month. The industry caters for such a broad spectrum of refurbishment finance now from large projects needing planning permission to minor alterations.

“Slightly surprised to see regulated loans down so much as we still see a lot of transactions where borrowers are taking advantage of these refurbishment loans on their own homes and then refinancing them out with a term loan once works are completed and value added. Similarly, second charge lending still looking strong as borrowers want to utilise equity in their property assets without disturbing the first charge debt which is often very good value so when blended with a second charge rate is still attractive overall on a short-term basis.

“Whilst average LTV’s have increased overall gearing is still very modest which I think is a healthy sign when many pundits are showing concern about rising household debt in the UK.

“Good to see turnaround times coming down (but still looking almost inexplicably long) and rates still being sub 10% p.a. as well which I expect to see fall further next quarter.

“Although the term of loan taken is now just under a year it would be interesting to know from lenders what the average term that the loan is actually held on their books for.”

Paul McGonigle, Chief Executive of Positive Lending comments:

“Regulated bridging transactions for us were high in Q2, so it’s a surprise to see such a significant decrease. What was evident though and as the data suggests, is that refurbishment was definitely the key reason for unregulated borrowing during the period.

“Now is the time for a proper bridge-to-let product to support these refurb deals. Lenders should look to fine tune their offering- with one underwriter, not two, so that property investors and developers can access the finance they need, with speed and with minimum fuss.”

Dave Fathers, Director, Sales at Finance4Business comments:

“If you look at our book, the levels are weighted even more towards unregulated than regulated for Q2, with 81% of what Finance 4 Business wrote falling under the unregulated banner. The simple reasons for this are that we have seen a large surge in unregulated applications from our clients and brokers alike, coupled with the fact that a lot of the networks are giving their AR’s (who generally attract a higher level of regulated cases) the opportunity to deal directly with the lender.

“As the competition remains strong amongst the bridging lenders, with new entrants coming through and others fighting for a larger marker share, we are seeing a steady decrease in the average monthly interest rates when looking at each quarter on quarter which is great news for our clients. The specialist market is very well established and with borrowing interest costs reducing, property traders are turning to this type of finance more than ever before.

“We are half way through Q3 now and we are set to break all records again, we are not seeing any let up at the moment, but we are experiencing slower-than-average completion timeframes and we are simply putting this down to professional 3rd party capacities being stretched along with clients being better prepared and needing the ‘rapid bridging completion’ less and less.”