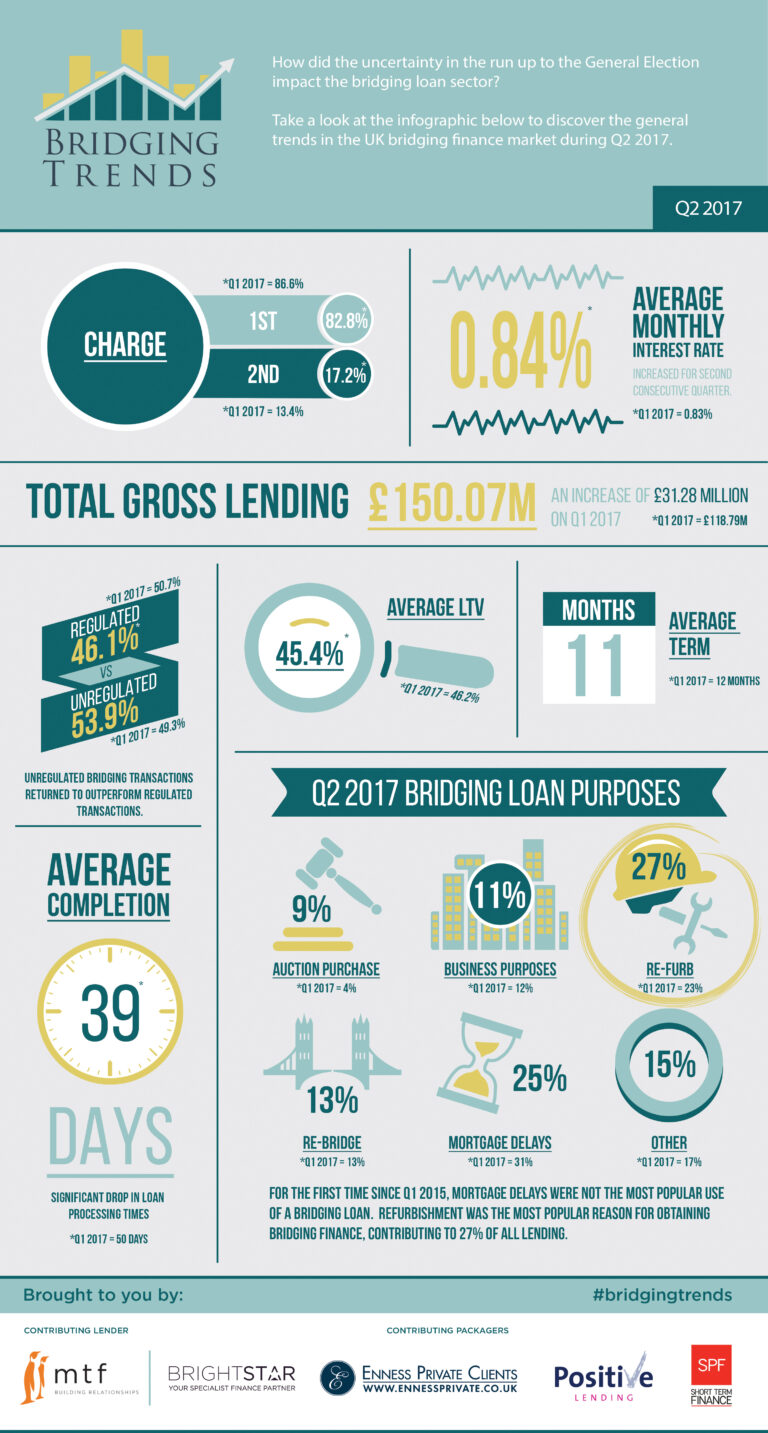

Take a look at the infographic below to see the trends that shaped the bridging finance market in the second quarter of 2017.

Key Points:

Lending reaches record high at £150.7m

LTV levels hits new low of 45.4%

Average completion time drops 11 days

Refurbishment most popular reason for first time

Director’s comments

Joshua Elash, director of bridging finance lender mtf, comments:

“Demand for specialist finance remains strong. Notwithstanding a slight increase in the average monthly cost of credit to the consumer, which is up for the 2nd consecutive quarter. Most interesting however, for the first time since reporting began, mortgage delays are not the most popular use of a bridging finance loan, having been replaced by refurbishment. Whilst it is too early to form any conclusions this may be indicative of a shift in the market, coming off the back of recent increases in stamp duties, and the changes to tax relief on buy to let property, more investors in this quarter focused on adding value to their existing investment properties.”

Paul McGonigle, Chief Executive of Positive Lending, comments:

“I am not surprised that the report shows increased lending figures, particularly in the non-regulated refurbishment market. Brexit concerns appear to restrict some lenders where higher lending refurbishments on larger value stock are required.

“This has certainly been the growth area for Positive Lending, and whilst this reflects in the bridging sector too, with some lenders, there are others that have the experience and appetite to assist. These tend to be shorter term lends than the report suggests but would also suggest that the riskier loan carries a weighted rate. If we analyse our business split away from this sector, the rate would drop significantly to an average of 0.68%.”

Chris Borwick, Director at SPF Short Term Finance (SPF), comments:

‘’Despite Theresa May’s announcement back in April that there would be a snap general election on 8th June, any uncertainty in the run up to it did not ripple through to the bridging world. This is evident in the figures we are seeing today, including the whopping £18.64m increase of lending on the first quarter of this year. The report as a whole re-iterates the fact that the bridging market is going from strength to strength, with an increasing number of lenders coming to the fore with innovative products, as well as customers being made more aware of its uses and benefits.’’

Chris Whitney Head of Specialist Lending at Enness Private Clients, comments:

“Although lending volumes are up on the previous quarter, the level of gearing still remains very modest and even down on the previous results. I think this evidences to critics who have said that the industry is using irresponsible lending practices and that gearing is available at levels that are too high, simply isn’t true. A majority, if not all this type of lending is also at interest rates fixed at outset so the borrower knows exactly where they stand.

“Second charges are increasingly popular as borrowers want to hold on to historic low rate deals but can’t get the same lender to provide further advances. I think we have seen rates fall in the second charge market and lenders, such as Castle Trust, with specific products for this.

“I believe the short-term lending industry will see increasing levels of refurbishment (light, heavy and full development). We are seeing an increasing trend of clients ‘bridging’ a transaction and then instead of moving the loan away, they are preferring to stay with the same lender to do the works based on the efficient and timely service they have received from the lender on the initial loan, even though the rates are higher than the high street names that continue to fall short of client needs and expectations.

“I am pleased to see longer terms prevailing. In the recent past, we have seen too much ‘re-bridging.’”

Kit Thompson, Director – Short Term Lending & Development at Brightstar, comments:

“Great to see the highest lending figure since reporting started in Q1 2015, which is fantastic news for the sector, which continues to grow in size with continuing high demand for short-term funds.

“With the initial shock of Brexit last year and the General Election done, the market continues to thrive. The shift in use of funds from mortgage delays to refurbishment is not a surprise, as home-movers are most likely to be cautious when considering a house move at this time, with many parts of the country experiencing static house prices currently and concerns over buying at the peak of the market.

“However, property professionals realise there are still some great property deals out there, especially when looking to increase the value of the asset via refurbishment. At Brightstar we have seen an increase in applications involving renovation and refurbishment and a huge increase in demand for development finance as well.

“Great to see the completion time dropped down to 39-day average, which I think is as a result of more non-regulated transactions. It tends to be the regulated bridging loans that caused this figure to increase in the past as the transaction was linked to property chains which take time. The property professional is usually looking to get the deal done fast and move on to the next project, so we would expect completion times to fall as unregulated loans increase.”