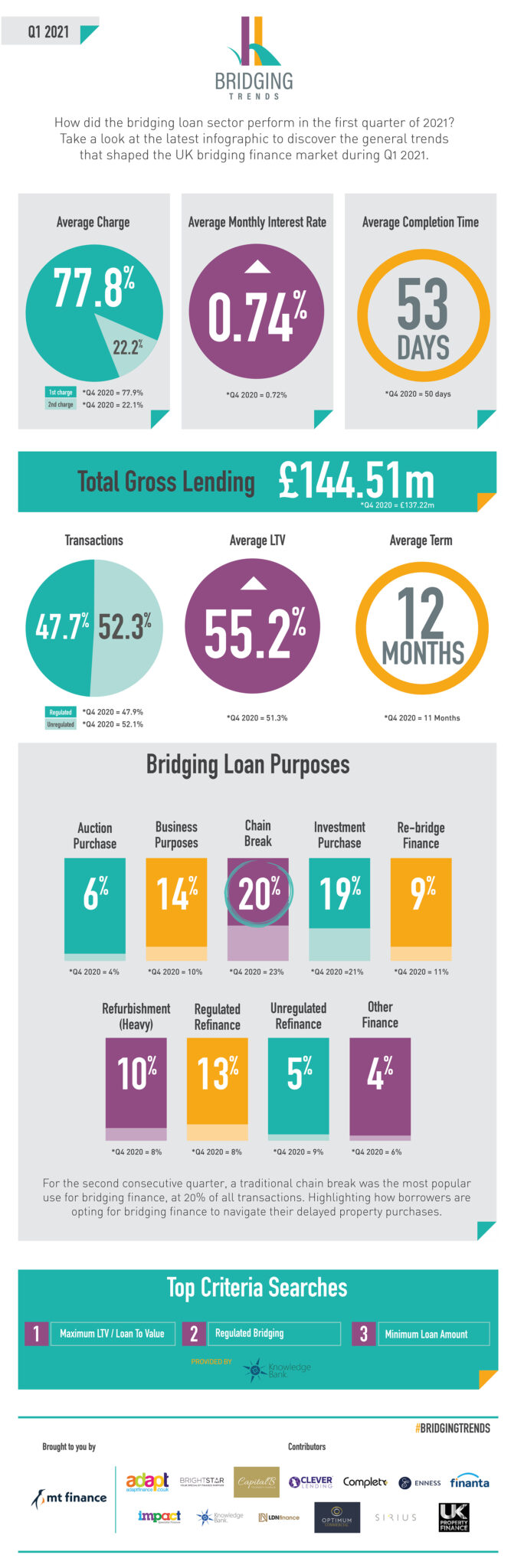

Take a look at the infographic below to see the trends that shaped the bridging finance market in the first quarter of 2021.

Key Points:

Bridging loan market stabilised

Interest rates fell to lowest level ever recorded

Average LTV climbs to 55%

Director’s comments

Kimberley Gates, Head of Corporate Partnerships, Sirius Property Finance comments:

“It comes as no surprise that bridging loan transactions have increased again from the previous quarter – the property market continues to be turbulent for a variety of well publicised reasons so borrowers are looking for increasingly innovative ways to structure their debt.

“The stigma surrounding bridging also continues to subside as more investors, developers and homeowners are starting to see it as a useful tool for realising their real estate goals and no longer as a last resort.”

Sam O’Neill, Head of Bridging, Clifton Private Finance comments:

“It’s good news across the board…increased borrowing and lower rates- what’s not to like?

“Gross lending being substantially up isn’t a surprise, looking at our figures, enquiries are up, applications are up, and completions are up. Could this be linked to increased competition in the lender market and historically low rates which are also reflected in the data? Could we be still looking at long standing hangover figures from the surge that the stamp duty holiday brought, or could this be the new normal?

“The increase in chain break transactions and regulated bridging is another positive sign. An increasing number of homeowners are seeing bridging finance as something they can confidently rely on and trust it as a viable financial product. When looking for reassurance that the industry is going in the right direction, we can’t ask for more positive feedback than that.

“We have seen some lenders capitalise on the ever-decreasing USP’s available in the market but smaller loan amounts at decent rates have been snapped up so I think the minimum loan amount criteria search might see some traction over the next quarter. I don’t see this hugely boosting lending volumes but perhaps this may be reflected in transaction volumes.”

Dale Jannels, MD, impact Specialist Finance comments:

“This latest Bridging Trends highlights more than ever that cash is king. This applies to homeowners wishing to get their offer accepted before they have sold their own property, as well as investors wanting to raise funds quickly to invest in stock or refurbish existing to achieve better yields for example.

“The shortage of suitable housing stock will undoubtedly drive increased volumes in the bridging sector for the foreseeable future.”

amount’. Interestingly, we’ve seen an increasing number of borrowers look to bridging finance to make minor improvements to properties, in contrast to the beginning of the 2021, where this search term rarely featured.”