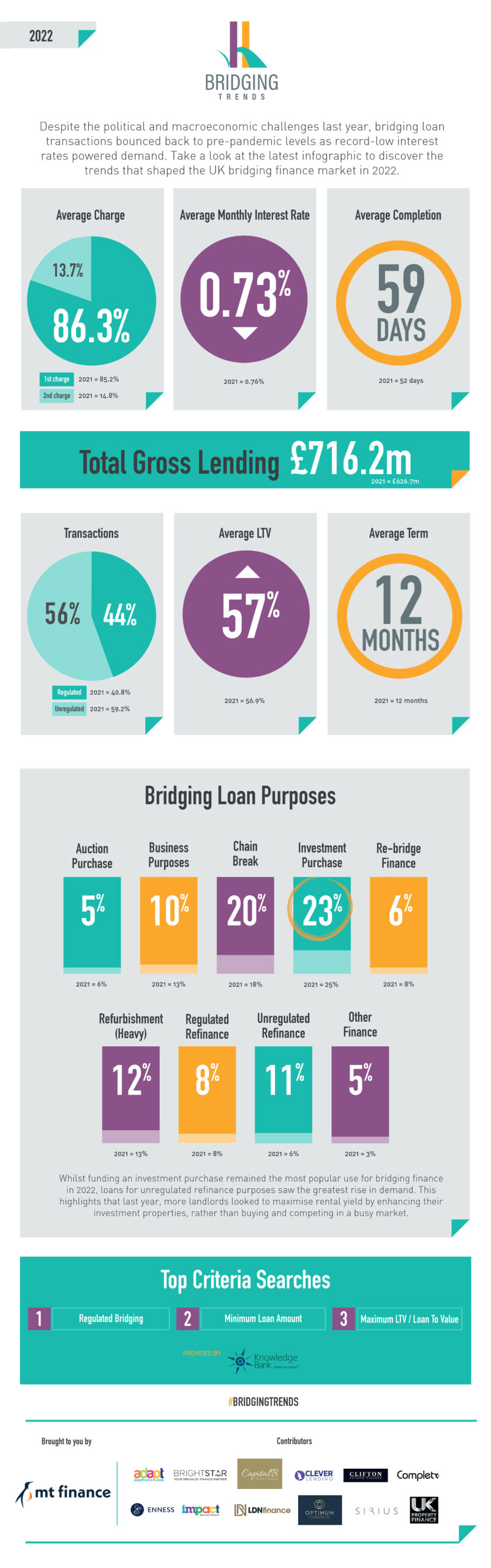

Take a look at the latest figures to discover the Bridging Trends that shaped the UK bridging finance market during 2022.

Key Points:

Gross contributor lending up 14%

Interest rates fell to lowest level recorded

Completion times climb as industry feels pressure

Regulated bridging demand increase

Director’s comments

Dale Jannels, managing director of Impact Specialist Finance comments:

“With the lack of housing stock unlikely to change in 2023, along with continued affordability challenges for borrowers due to increased interest rates, the use of regulated bridging to fund onward purchases before their current home is sold will remain a viable option. I do not expect to see a reduction in its use any time soon.

“It is also interesting to see an increase in unregulated refinance and I expect to see this trend continue with landlords making HMO conversions, plus a realisation from more and more landlords that the EPC regulations aren’t going away. This will lead to more improvements will be made to improve energy efficiency in older properties especially.”

Chris Whitney, head of specialist lending at Enness

comments:

“The 2021, 2022 comparison doesn’t really give us any surprising data. Both years had their challenges for different reasons in terms

of the macro economy. However, the numbers seem to indicate that borrowers were very much in a ‘keep calm and carry on’ mentality. I think we saw lenders (in the main) take the same view and adapt to things like cost of funds increases swiftly. Still modest LTV’s overall, indicating responsible borrowing and lending.

“The healthy increase in borrowing was nice to see and confirms what we already know, the bridging finance market has matured, here to stay, and a tool increasingly used by borrowers as a matter of course rather than just by exception.

“2023 will, I am sure, also have its challenges but the mood in the market as we kick the year off seems hugely positive.”

Sam O’Neill head of bridging at Clifton Private Finance

comments:

“It’s good to see faith in the bridging market back to pre-pandemic levels. Bridging loans plugged a large gap during Covid-19 for SDLT cuts, opportunities due to market uncertainty, along with a whole host of other reasons. The market seems to have certainly weathered the storm in spite of a generally gloomy economic state.

“The bridging finance sector has leapt further into the spotlight over the last few years and hopefully, with ever increasing confidence in lenders and the products they provide, bridging finance will become a mainstay in the property funding process for years to come.”