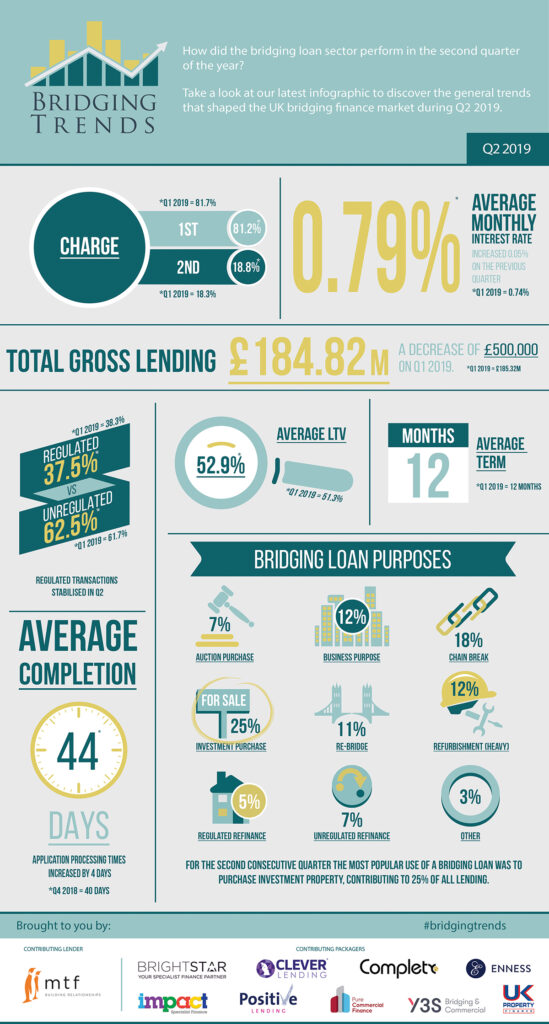

Take a look at the infographic below to see the trends that shaped the bridging finance market in the second quarter of 2019.

Key Points:

Investment property purchase most popular use for bridging finance

2nd charge lending saw slight increase

Bridging lending stabilises in the second quarter

Director’s comments

Gareth Lewis, Commercial Director at MT Finance comments:

“Now that Boris Johnson has been announced as the new PM and has made Brexit top of his to-do list, this should help give the market the certainty it needs. If the rumours of a stamp duty overhaul are true- we expect the change to ease the pressures of regulation and excessive taxation on UK property investors. It will be interesting to see what happens over the coming months, but hopefully the sector can look forward to buoyant growth.”

Dale Jannels, Managing Director of Impact Specialist Finance comments:

“I’m not surprised that Chain Break Finance was the second most popular reason for obtaining bridging finance in the last quarter. We’re in uncertain times and this uncertainty transfers into property transactions also.

“Customers are also being gazumped and looking for short-term finance assistance to speed up the purchase of their dream property. Add in the complexity of many property transactions and the high-street lender will say no, yet short-term finance might get them over the initial line.”

Kit Thompson, Director – Short Term Lending & Development at Brightstar Financial comments:

“There continue to be opportunities for property investors to grow and diversify their portfolio and bridging finance provides a fast and flexible form of funding that enables them to leverage their capital and make the most of these opportunities. This is a trend we expect to see continuing well into the future.”