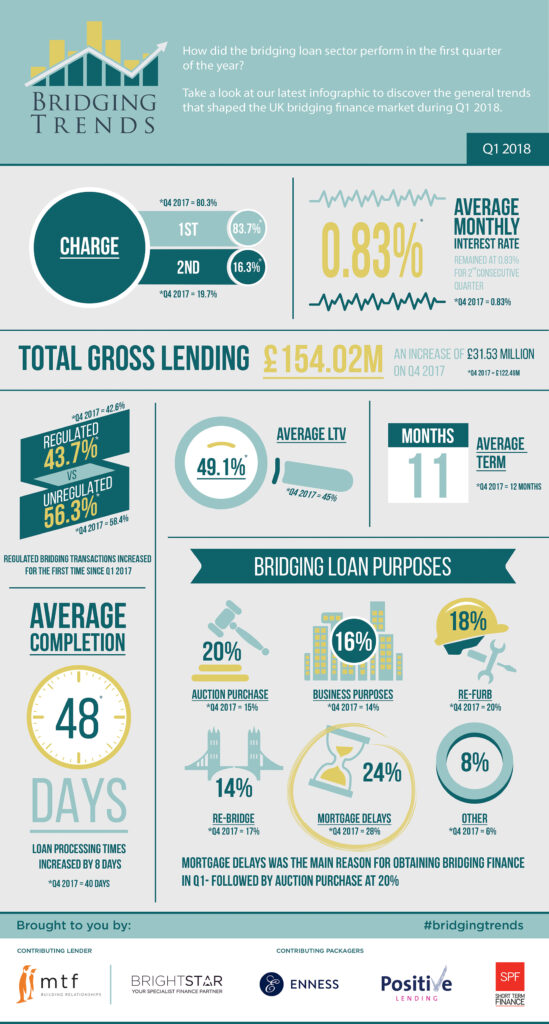

Take a look at the infographic below to see the trends that shaped the bridging finance market in the first quarter of 2018.

Key Points:

Contributor lending reaches record high at £154.02m

Bridging loan demand peaks for auction purchases

Average monthly interest rate holds steady at 0.83%

Regulated bridging loans increase for the first time in a year

Director’s comments

Joshua Elash, Director of Bridging Finance Lender, mtf, comments:

“It is particularly interesting that pricing has remained stable, despite an increase in regulated lending. This suggests that the recent downward pressure on rates might be easing and in the unregulated space, going the opposite way.

“Also, particularly interesting is the increase in bridging loans for auction purchases, considering the otherwise quiet property market, where transactional volumes have been adversely impacted by recent changes to buy-to-let income tax treatment and exorbitant increases in stamp duty.”

Tomer Aboody, Director of Bridging Finance Lender, mtf, comments:

“Bridging volume has peaked to its highest level as the product becomes an increasingly mainstream financial tool. This is good news for borrowers that are able to access fast and vast pools of capital to fulfil their short-term funding needs as well as a growing number of investors attracted to the space.”

Chris Whitney Head of Specialist Lending, Enness, comments:

“We’ve undoubtedly seen an increase in volume for bridging finance, but I also wonder if the breadth of lending that specialist lenders now provide is a contributory factor. For example, by definition, bridging loans are a short-term finance facility. However, that definition is now being stretched, with bridging lenders often able to offer facilities for up to two or even three years now.

“Lenders are also offering loans for more varied purposes, like ground-up development. We now even have Sharia-compliant facilities in our toolbox, allowing us to cater for a wider audience. Therefore, the increase in lending perhaps results from there being more things you can ‘do’ with bridging.

“I also think much of the increase in volume is outside of London and the South East, with other areas of the UK playing catch up from previous years. Again, this is because lenders are widening their nets, working across the UK and lending into the Republic of Ireland, Northern Ireland, Scotland, and so on. Ultimately, we may soon need to be having a conversation about what constitutes a bridging loan, in order to gain true insight into what the market is doing. “