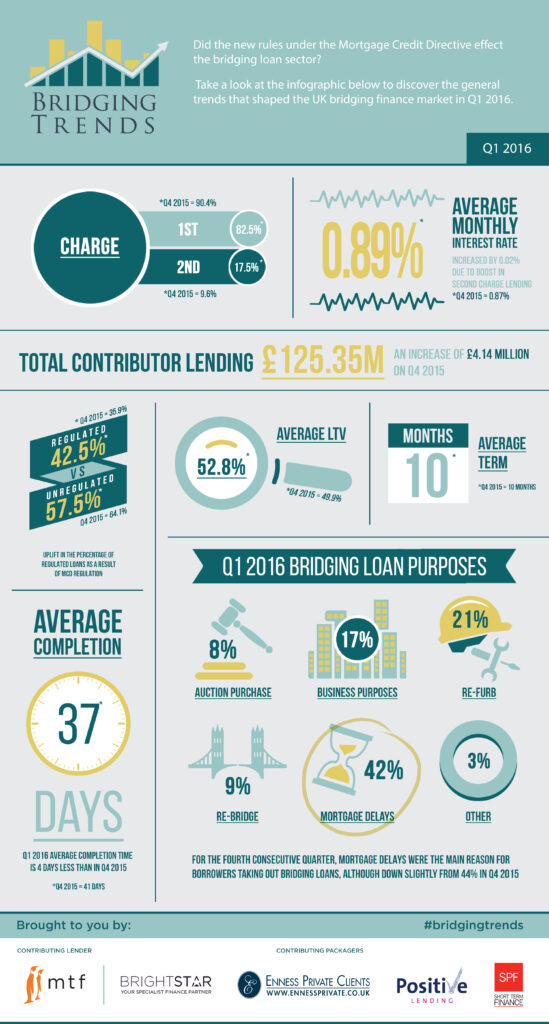

Take a look at the infographic below to see the trends that shaped the bridging finance market in Q1 2016.

Key Points:

Annual gross bridging lending jumped by 56%

Average completion time decreased to 37 days

Mortgage delays most popular use for bridging loans

Regulated loans increased to 42.5%

Director’s comments

Joshua Elash, director of bridging finance lender, MTF:

“It is positive to see an increase in the gross lending volumes and although there has been upward movement on both the weighted average interest rates and LTVs, both continue to suggest that the market is healthy for consumers and is behaving responsibly.”

Kit Thompson, Director of Bridging Loans at Brightstar:

“Once again the biggest reason for someone taking out a bridging loan is because of delays with their long term mortgage. This is shocking and causes unnecessary costs for borrowers.

It is always a surprise to me that a mainstream mortgage takes such a long time to complete given that so much of the process is now automated at so many lenders, whereas a bridging loan which is underwritten individually on a case by case basis can be completed in under forty days.

While it is full credit to the bridging industry that they can rise to the challenge to ensure that people do not lose the opportunity to buy their new home, it is surely time that mainstream mortgage lenders did likewise.”

Chris Whitney, Head of Specialist Lending at Enness Private Clients:

“Steady as she goes is probably quite healthy for lenders and borrowers alike, but not great for news headlines.

“However, I think the focus on the Brexit vote has now intensified so it will be interesting to see what impact that has on the next set of data. Market sentiment is mixed on the impact it will have, not in terms of the outcome itself, but more to do with the uncertainty the vote brings.