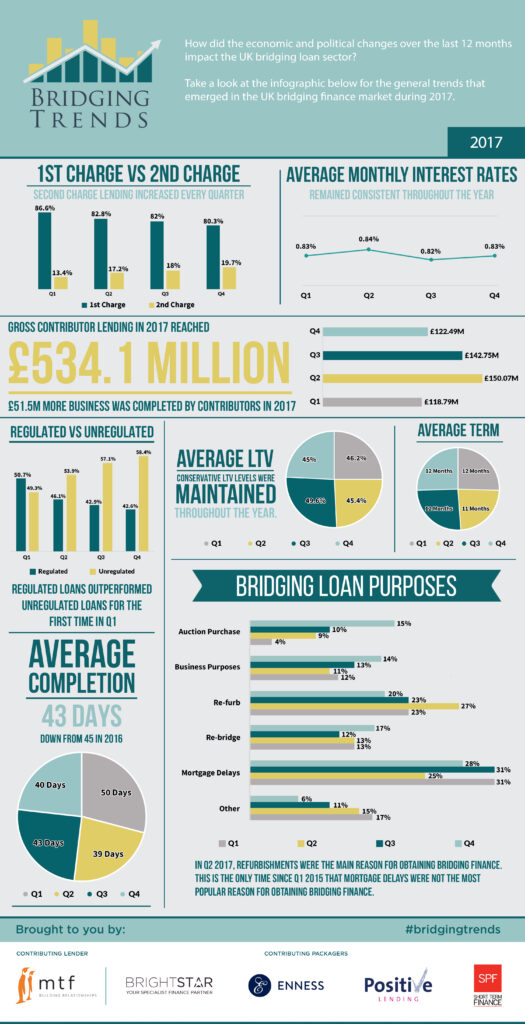

Take a look at the infographic below to see the trends that shaped the bridging finance market in 2017.

Key Points:

Bridging loan volume rose 10.7% in 2017

2nd charge loans increased every quarter

Regulated loans increased market share

Director’s comments

Joshua Elash, director of bridging finance lender, mtf, comments:

“The continued growth in lending volume in this sector, as reflected by the data reported by the contributing parties over the year, evidences the extent to which bridging finance is now increasingly a mainstream financial solution.

“It is interesting to note the what appears to be a direct correlation between the data reported and the macro-economic and regulatory changes which have impacted upon the market. We have, for example, in this annual reporting cycle, seen regulated bridging finance lending outstrip unregulated bridging finance for the first time. This follows on from the implementation of the mortgage credit directive and the consequential introduction of a new class of regulated “consumer” buy to let lending.

“Equally we are interested to note that again for the first time since reporting began, refurbishment to existing investment property was the most popular reason for borrowing during Q2 of last year. This follows on from increases in the stamp duty taxes payable on the acquisition of new buy-to-let properties and indicates a potential strategy shift amongst professional property investors towards value enhancement.

“As we look ahead to the year 2018 we are interested to see how these two trends in particular pan out. In the interim and what remains certain is that bridging finance as a financial solution continues to go from strength to strength.”

Chris Whitney Head of Specialist Lending, Enness Private Clients, comments:

“Between stamp duty costs and stagnation in the London property market, it’s no wonder bridging finance for refurbishment is becoming increasingly popular. To avoid heft stamp duty charges, many more clients have been buying cheaper or outdated properties, and using second charge bridging finance to update them before refinancing onto a residential product. Likewise, we’ve seen numerous client looks to raise money against their properties who do not want to refinance altogether. As such, they’re using regulated bridges as second charges against their property, in order to keep their attractive first charge mortgage whilst securing the extra funds they need.

“Encouraging to see an overall increase in the total amount of bridging originated by the contributors to Bridging Trends, indicating a strong and resilient bridging sector that can survive what was a tough year with numerous obstacles to overcome, including MCD, PRA and tax changes for BTL / second properties and not least the long-drawn out Brexit negotiations.”

Kit Thompson, Director of Short Term Lending & Development at Brightstar, comments:

“Our business has seen a large increase in bridging for property refurbishment, with an increase in PDR schemes and change of use projects. In fact, with the exception of our FCA regulated bridging, which by contrast doesn’t generally involve refurbishment, almost all of our non-regulated bridging loans here at Brightstar involved some element of refurbishment, whether just light refurbs or those projects involving change of use and planning consent.”